As we speak, the headlines are blaring the missile strike Iran did against Israel. We all know that if the weekend was the week both Crude Oil and Gold would surge. I want to assume Natural Gas as well. But war fear is something I don’t like to trade because usually it pays to do the opposite of the price action the fear is based on.

The timing of it gives the White House and the markets to digest the news and act a little more rationally than a knee jerk reaction aided by algorithmic AI trading bots.

The purpose of these articles is to point out the fundamentals of commodities so we can take longer term positions and be patient for the harvesting of the opportunities presented. Not just a flash in the pan move that you need to be right, with a lot of money behind you. Otherwise, you’ll hit it big sometimes and lose other times.

A few weekends ago, I had the pleasure to read the case for the negative outlook for Natural Gas, rightly or wrongly, on the www.ft.com website. Regardless, Natural Gas did in fact crash. It is now the age-old question of “should I catch a falling knife?”

Before we proceed to review the article, just remember to ask yourself where was the FT when Natural gas surged into the beginnings of the Ukraine war and its consequential crash. What we are going to do is see if we can ascertain their logic and the facts behind the article. Sometimes you can learn something that wasn’t considered before.

The article we will review can be found at:

https://www.ft.com/content/81819f64-1025-489b-959a-c3d9b14cc77a

It’s probably behind a paywall and do suggest a subscription even if you do not agree with its content, their comments section is golden.

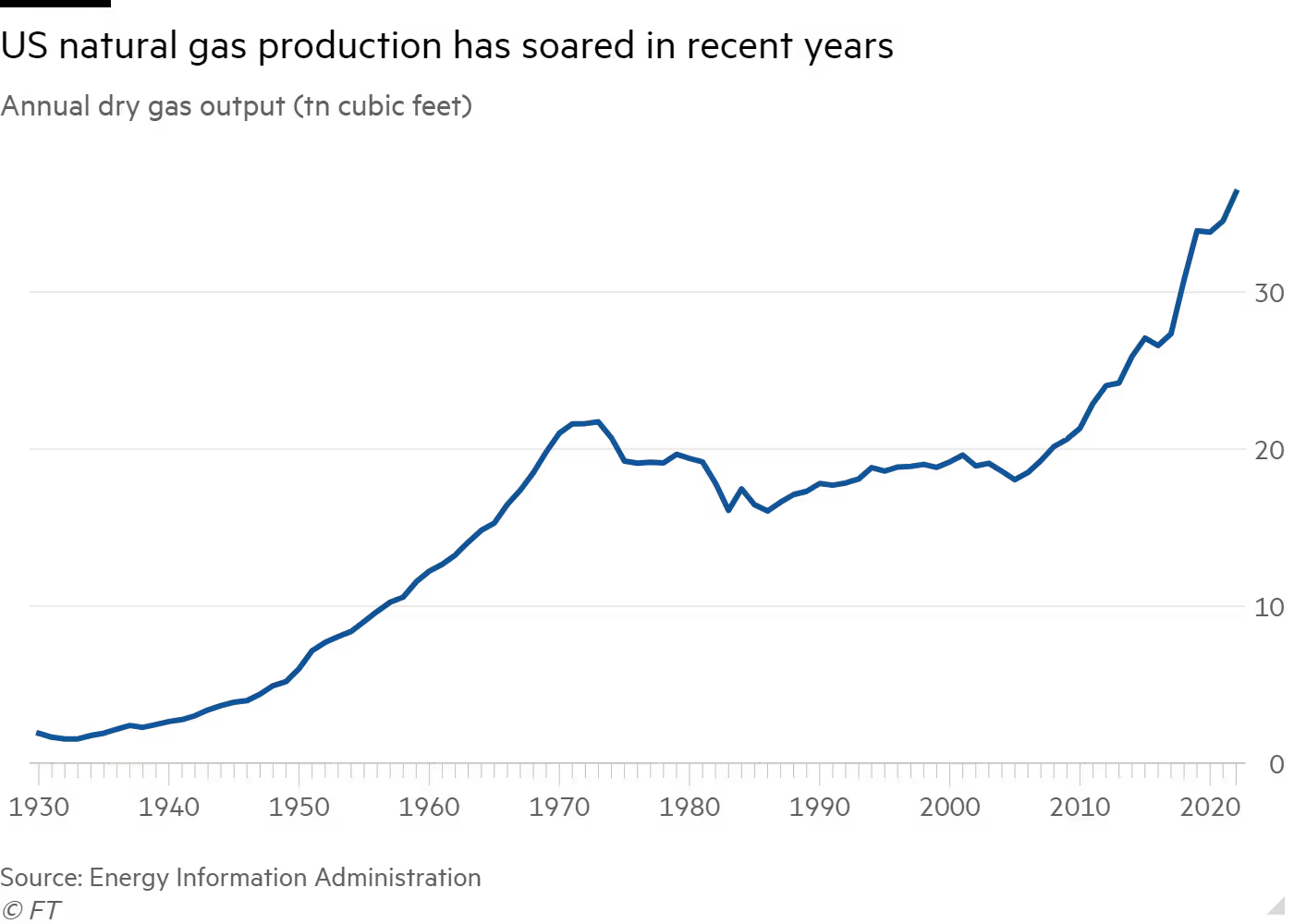

The main argument for lower natural gas stares you in the face with this chart. A chart that I have consistently ignored. It’s evidently basic that record high production without record high demand will lead to lower prices.

Let’s review this first:

It is obvious not just from logic but reality more production without similar demand will lead to lower prices. Hence, the prices hovering around 20 year lows. The question is with rising demand, but not record demand, and higher oil prices along with inflation - how low can Natural Gas get?

Recently, I had a partial answer from this great blog post on Zerohedge:

Zerohedge on Natural Gas going negative in Texas

Apparently, when Crude Oil is high and the driller focus their attention on crude oil, natural gas is a by product that is essentially free and the glut is creating negative pricing in some oil areas, like Texas. My thesis is that long term we are going to see sustainably high Natural Gas prices but probably not in the short term. A tip that Zerohedge mentioned in the article is reading anecdotes from the Dallas Fed. Enclosed is the link for you to read yourself:

https://www.dallasfed.org/research/surveys/des/2024/2401#tab-comments

The highlight I want to share is:

The Great Turnover (wave of retirements backfilled by greenhorns) is continuing to result in elementary mistakes in land work, division orders, and, thus, revenue distributions from oil and gas purchasers. I am seeing increased joint interest billings errors. Collectively, this is causing a diversion of staff time. The greenhorns in the positions making these mistakes are defensive and insisting they are right even when confronted with the facts. Washington’s war against domestic oil and gas is winning. Accounting firms don’t want oil and gas firms as clients, preferring only clients in a so-called reputable industry. Bankers are stiff-arming discussions.

The lack of new talent and lack of financing will create such shortages that the entire energy sector is woefully cheap long term. What will probably happen is we will be a net importer of energy and geopolitics will be more in demand then ever. We will be getting back to basics. There is no question, but until that begins we will be behind the necessary planning of 4-6 years (Biden administration and 2 years of Covid).

The US economic power and diversification of checks and balances has allowed it to be mismanaged and probably will continue to do so, but this probably continue until it hits consumers wallets.

Investing currently requires the subtle art of observing and less emotion. Maybe it always did, but with so much information to distract it does require a certain nuance.

I found this one company that may help in participating in Natural Gas when it indeed become necessary to reinvest, Diversified Energy Company (DEC). More on this company at a later date. Fun fact, it pays 30% dividend which is outrageous! So do your own due diligence because a stock like this can cut its dividend and may go to 0. But what if its like Coal companies that yielded something like this and went up 10x ?

Too much natural gas? or is there another reason…