Especially now, not only everyone has an opinion and you hear about it whether you like or not with all the forms of communication we have now. But what is even more nefarious is that with the deluge of information we really don’t know what is dressed up as facts anymore.

Rarely have my opinions played out the way I have expected. So while it may appear that I write often in that manner, I feel that if my facts are not solidly under my grasp I aspire for experience.

Most of our life now is as if we know something, but what we are really doing is window shopping. We see but we do not touch. The same with “experiences” that we feel we have on a “vacation” but it’s all pre-packaged and you know what you get. And if you don’t you sure tell the hotel manager what you think.

A real “experience” is most certainly in investments where while we can look back and say it made sense, you probably didn’t think that in the heat of the moment. Maybe that’s why the casino and investing area attracts so many people?

As I write that, I’m thinking it’s a paradox to put “investing” and “casino” in the same sentence but when you see the Treasury Secretary not backstopping, or calming the banking sector we most certainly need to say the mantra that’s on the US Dollar “In God We Trust.” As we cannot trust the brain power in Washington.

No one wants to lose, and I hope to provide useful experience and facts to tilt the odds in our favor.

So here is a brainstorm - if banks are the achilles heal now in regards to stock market energy what is a way to play this where you won’t get hurt too bad if you are wrong, but make some good profits if you are right?

Facts:

Nasdaq has limited bank exposure and is outperforming SP500 and DJIA. The Russell2000 which contains regional banks is seriously underperforming.

The large banks that are too big to fail and also paying +4% dividend yields rally big on days that government calms the market, and sells off on days that they do not.

Currently, lets assume a $10,000 investment:

$2500 on banks like JPM, C, and BAC

$2500 QQQ

Short $5000 of SPY etf

The logic?

Banks can go down, but so can the SP500. The banks will pay 4% so you have that cushion and you have tech sector staying relatively strong.

Do your own research and maybe this little letter will show how to take facts and experience of market movement to capture some profits while your competitors in the markets are not up to date.

Regards,

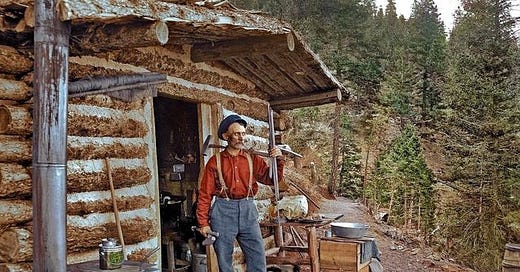

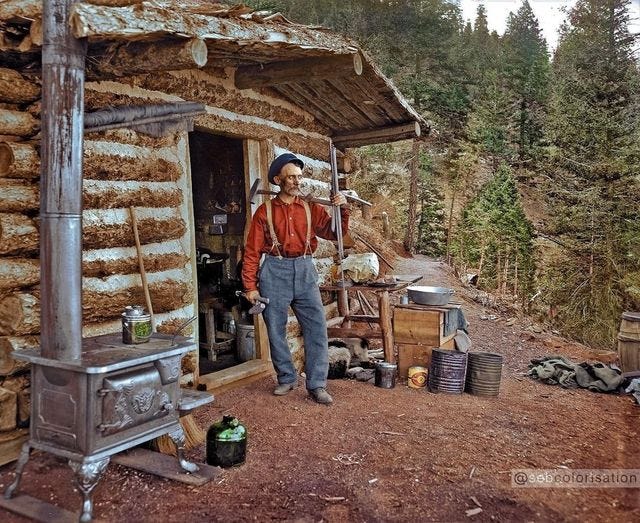

Here is a prospector, a real life one, in 1900s in color and in Colorado. That was an experience I’m sure and would like to have some bitter coffee with him to hear his story. But am thankful? we can do it in A/C with Starbucks and a click of the button.